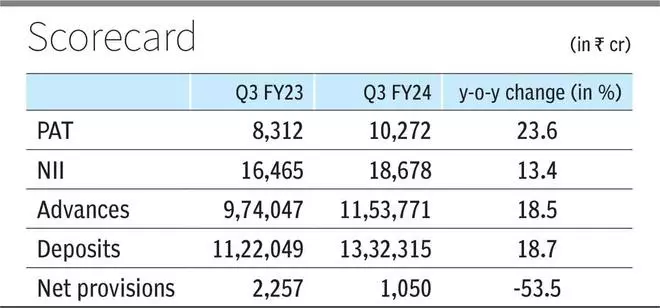

ICICI Bank’s net profit rose 23.6 per cent y-o-y to ₹10,272 crore in Q3 FY24. Sequentially, the profit after tax was flat from ₹10,261 crore a quarter ago, largely due to higher provisions.

Provisions for the quarter were ₹1,050 crore which included a one-time impact of ₹627 crore provided against the bank’s AIF investments.

Net interest income (NII) increased 13 per cent y-o-y and 2 per cent q-o-q to ₹18,678 crore. Net interest margin (NIM) for the quarter was 4.43 per cent, lower than both 4.53 per cent a quarter ago and 4.65 per cent a year ago.

In the earnings call, Executive Director Sandeep Batra said that while margins are under pressure due to higher cost of funds, margins for FY24 should be at a similar level as 4.48 per cent for FY23.

Advances

Total advances increased 18.5 per cent y-o-y and 3.9 per cent q-o-q to ₹11.5 lakh crore, of which domestic loans were at ₹11.1 lakh crore, up 18.8 per cent on year and 3.8 per cent on quarter, with Batra saying there are growth opportunities across retail and corporate segments.

Retail loans grew 21 per cent y-o-y and 5 per cent q-o-q to ₹6.4 lakh crore, comprising 54.3 per cent of total loans as of December 2023. Business banking loans were up 32 per cent on year, SME business by 28 per cent, rural portfolio 18 per cent and domestic corporate loans by 13 per cent.

EXPOSURE TO NBFC

ICICI Bank’s exposure to NBFCs has fallen to around ₹74,000 crore from ₹79,900 crore a quarter ago, primarily due to repayment by certain PSU companies, Batra said, adding that the bank has reviewed the portfolio and is “comfortable with the quality of the book”.

Deposits grew 18.7 per cent y-o-y and 2.9 per cent q-o-q to ₹13.3 lakh crore. Term deposits were up 31 per cent on year and 5 per cent on quarter to ₹8 lakh crore, with Batra saying that the bank continues to see strong traction in retail term deposits.

CASA deposits grew 3.8 per cent y-o-y and were flat on quarter at ₹5.3 lakh crore, largely due to a sequential decline in savings deposits. Average CASA ratio stood at 39.4 per cent, lower than 40.8 per cent in the previous quarter and 44.6 per cent in the previous year.

The bank said that deposit and loan growth has been quite balanced, and it doesn’t see any challenges in funding this level of growth or constraints in garnering deposits.

Slippages for the quarter were ₹5,714 crore which Batra attributed primarily to seasonal NPAs in the KCC (Kisan Credit Card) portfolio and normalisation of NPAs in the retail portfolio. These were largely offset by recoveries and upgrades of ₹5,351 crore and loan write-offs worth ₹1,389 crore.

Gross NPA ratio declined to 2.30 per cent from 2.48 per cent a quarter ago and 3.07 per cent a year ago. Net NPA ratio was at 0.44 per cent, slightly worse than 0.43 per cent in the previous quarter but better than 0.55 per cent in the previous year.