Match may have settled its antitrust lawsuit with Google last week, but Fortnite maker Epic Games is still set to go to trial with the tech giant today, November 6, in hopes of convincing a jury that Google engages in anticompetitive behavior with regard to its Android app store, Google Play, and its commission structure. This case will differ slightly from Epic’s battle with Apple on the same topic because, this time, Epic can’t allege there’s no other way to load apps onto Android devices, as it could with Apple, because Android does allow for sideloading apps. Though Epic will suggest Google makes that process cumbersome, the bulk of its arguments will center around what it believes are anticompetitive agreements between Google and device manufacturers and developers.

The precedent Epic’s case will rely on is a Microsoft case where courts found Microsoft to have a monopoly over the operating system and were abusing it, making it hard for users to download alternative browsers, like Netscape, on Windows devices.

To make its case, Epic plans to bring claims under Sections 1 and 2 of U.S. antitrust law, the Sherman Act, as well as California’s anticompetitive laws, the Cartwright Act, and the Unfair Competition Law. It will attempt to argue that Google restrains competition within two separate markets, including the distribution of apps to Android users and the market for payment processing solutions for content inside Android apps.

Google argues its commissions aren’t just tied to billing, but offers discount for third-party billing options

Today, Google requires apps to use its own first-party billing system, and charges app developers a 15% to 30% commission on the sales it processes.

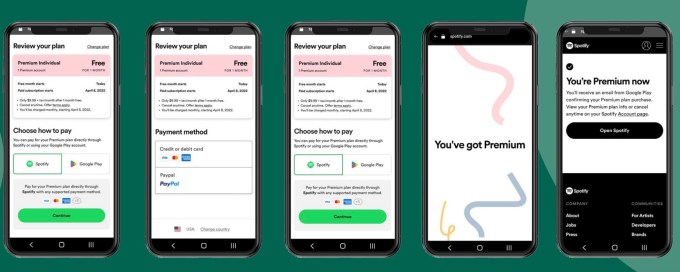

However, Google will counter Epic’s arguments by pointing out that it has rolled out a new option for app developers called User Choice Billing, which Epic has declined to use. This program, still in pilot testing, is open to all developers who sell apps in the 35 markets where it’s now available, including the U.S., and reduces the standard commission by 4% for companies who choose to use their own payment processing solution. Spotify and Bumble were the initial testers for the new system, first introduced in November 2022, and Match, as part of its settlement agreement, will also now take advantage of this option.

Image Credits: an example of Google’s User Choice Billing option in Spotify’s app

Google will also argue that its commissions aren’t just tied to payment processing, but rather help it to develop other features and controls to keep Android users safe and guide them to discovering new applications, as well as help fund the tools and services developers need to build and grow their apps. Google also helps developers reach a broader audience beyond the mobile phone, with support for Android across platforms, ranging from tablets to TVs to autos and more. And it will note that 99% of its developers qualify for a commission of 15% or less, based on their revenues.

The competitive landscape with other app stores, OEMs

The tech giant additionally plans to push back at Epic’s claims that it doesn’t have competition in the app store business. It will point out that not only does the Play Store compete with Apple’s App Store, which the Ninth Circuit ruling in the Apple case agreed upon, too, but Android also supports competitive app stores like Samsung’s Galaxy Store and Amazon’s Appstore.

Epic, however, will attempt to demonstrate that Google makes it hard for alternative app stores to succeed and reach consumers, noting that 90% of apps are still downloaded through Google Play. And it will point out that Google bundles the Play Store with other Google apps that Android OEMs (original equipment manufacturers) have to agree to in order to use Android.

Epic will also bring up “Anti-Fragmentation Agreements” (AFAs) that prevent the OEMs from modifying Android to allow for frictionless downloading of apps outside of Google Play. Epic Games will specifically reference one agreement it had made with the OEM OnePlus, to make Epic games available on its devices through the Epic Games app. But OnePlus had to cancel the deal over concerns that the arrangement would have it bypassing the Google Play Store. The case will also examine a deal between Google and Samsung that Epic says was designed to prevent the Galaxy Store from being a competitive threat and require Google Play Billing on apps distributed by Samsung.

Epic will argue Google’s developer agreements are anti-competitive

A second set of agreements Epic will highlight are those between Google and Android app developers themselves. One such program, the “Project Hug” initiative, a part of the Google Games Velocity Program will be cited as an example of where Google paid competitors not to distribute their apps on Android outside of the Play Store by targeting those who were most at risk of attrition from Play, then approaching them with a monetary offer. As an example, Epic will point to Activision Blizzard, the owner of King.com and maker of Candy Crush and Call of Duty, as one developer who wanted to go the route of opening its own app store. Google and Activision Blizzard then entered into a three-year agreement in January 2020, worth approximately $360 million, to keep the developer on Google Play, Epic will argue.

Google, however, will characterize this program as a way to incentivize developers to launch their apps on Android at the same time as they launch on iOS and plans to dispute Epic’s claims that it prevented developers from opening their own app stores.

Android allows sideloading

Google will make note that, unlike Apple, it also allows apps to be sideloaded on Android devices — something Epic takes advantage of today. It will note this process is streamlined and helps keep users safe. But Epic will claim that this process is made to be overly difficult for end users, with multiple steps involved and “scare screens” that warn users of the security risks involved with sideloading.

Epic will also suggest that Google hid items from discovery by allowing execs and employees to have “off the record” chats, but Google will counter this as well, saying it has provided the court with thousands of chat logs and millions of documents.

The tech giant will ultimately push the notion that this case isn’t about competition, but about money — that is, Epic Games wants to reach the Play Store’s 2.5 billion users without having to pay.

“Android’s choice and flexibility work well for consumers and developers of all sizes. We look forward to making our case in court as we fight to keep our users safe from harm, partner with developers to grow their businesses, and keep the Android ecosystem thriving and healthy for everyone,” reads a Google blog post by Wilson White, VP, Government Affairs & Public Policy.

Epic’s lawsuit originally involved Match and several U.S. Attorneys General, but Google reached a settlement with the latter last month and with Match last week. Epic will now fight the antitrust battle on its own. The lawsuit, held in the U.S. District Court in California’s Northern District, will include testimony from a number of Google and Android execs, including CEO Sundar Pichai, and Epic Games CEO Tim Sweeney, as well as Apple, Netflix, and other Android developers.

Google is also involved in another antitrust lawsuit with the Department of Justice over its alleged search monopoly. Epic, meanwhile, lost its antitrust battle with Apple and is now asking the Supreme Court to weigh in.