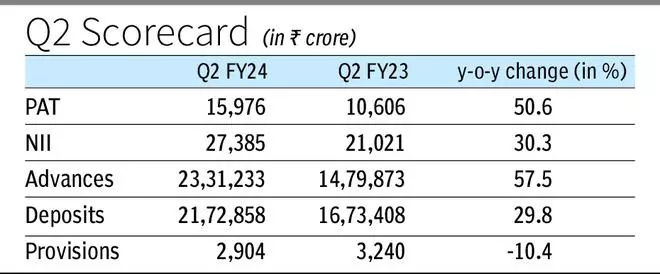

HDFC Bank posted a net profit of ₹15,976 crore for Q2 FY24, an increase of 50.6 per cent on year on the back of strong growth in net interest income (NII) and better asset quality.

The balance sheet of the lender ballooned over the quarter following the merger of erstwhile HDFC with the bank, effective July 1. Due to this and the different accounting principles followed by both entities, the year-ago figures are not entirely comparable.

In the post-earnings call, CFO Srinivasan Vaidyanathan said that the merger has been completed, IT systems have been integrated, and branches are operational. The bank is now working to “derive synergistic benefits along with subsidiaries” with the expectation that business momentum will gather pace hereon.

Income and margin

Net Interest Income (NII) rose 30.3 per cent y-o-y to ₹27,385 crore, supported by the surge in share of the secured housing portfolio following the merger. This also helped the credit cost improve to 0.49 per cent from 0.87 per cent a year ago, Vaidyanathan said, adding that the credit cost environment continues to be benign.

Net Interest Margin (NIM) for the quarter is 3.4 per cent on total assets and 3.6 per cent on interest-earning assets. Excluding HDFC’s debt-funded cost for additional liquidity and merger management, NIM was 3.65 per cent on total assets and 3.85 per cent on interest-earning assets.

As a lot of this additional liquidity was funded by long-term debt, the cost of borrowing for the bank is currently higher than the cost of deposits. Over a period, this ₹4.8-5.0-lakh crore of liquidity will either be utilised against high-yielding loans or progressively replaced by deposits, which will steadily boost margins, Vaidyanathan said, pegging the cost of fund differential at around 450 bps. The credit-deposit ratio for the bank increased to 107 bps from 84–85 bps pre-merger.

Deposits grew by ₹1.1 lakh crore post-merger to ₹21.7-lakh crore as of September 2023, up 29.8 per cent on year and 5.3 per cent on quarter. CASA deposits grew only 7.6 per cent y-o-y, whereas time deposits grew 48.3 per cent, resulting in a CASA ratio of 37.6 per cent at the end of September.

Advances increased by ₹1.1-lakh crore post-merger to ₹23.5-lakh crore, an increase of 57.7 per cent over the year-ago period and 4.9 per cent sequentially. Domestic retail loans were up 112 per cent, commercial and rural banking loans were up 30 per cent , and corporate and other wholesale loans (excluding non-individual HDFC loans of ₹1-lakh crore) were 7.9 per cent higher.

Vaidyanathan said that credit conditions and economic indicators remain strong, led by good domestic demand conditions and government capex. The retail-to-wholesale mix of the bank stood at 55:45 post-merger as against 47:53 pre-merger and 54:46 pre-Covid.

Also read: HDFC Bank gets rare analyst downgrade on loan growth concerns

Non-performing assets

On the NPAs inherited from HDFC’s wholesale book, Vaidyanathan said that the entire book has been recognised and the bank will now look at recoveries. He added that 22 bps of this book are current and performing but have to be recognised as NPAs because they are restructured accounts.

The gross NPA ratio of the bank was 1.34 per cent as against 1.41 per cent on a pro forma merged basis on June 30 and 1.23 per cent a year ago. The net NPA ratio was 0.35 per cent.