The beauty about numbers is that while it’s a plain fact, it’s also a matter of interpretation. HDFC Bank posting ₹16,811 crore net profit in September FY24 quarter (Q2) up 51 per cent year-on-year (y-o-y), is appreciable. But if we look at the numbers, adjusted for the mega-merger with HDFC Ltd, it’s a different story. For long-time observers of the bank, Q2 was one of the softest shows in recent times.

Net interest income grew by 6.7 per cent and net profit by 16.6 per cent. Loan growth was about 13 per cent. These numbers are far from the bank’s historical run rate and raises questions about who needed the merger most — HDFC Bank or HDFC?

Are numbers adding up?

HDFC’s loan book was ₹5.68-lakh crore as on March 31, 2022, with ₹1.37-lakh crore of wholesale loans. In FY23, wholesale loans declined to ₹1.21-lakh crore. On July 1, 2023, when the merger consummated, wholesale loans stood at ₹1.08-lakh crore. From March 31, 2022 to July 1, 2023, these loans have shrunk by ₹29,000 crore. On September 18, two months after the merger (and after over a year of rigorous due diligence), HDFC Bank had identified ₹38,000 crore of HDFC’s loans which would require specific provisioning. In short, nearly ₹66,000 crore or 10 per cent of HDFC’s FY23 loan book have been identified as untenable post the merger announcement. Was the merger a bailout for HDFC rather than a valuable addition for HDFC Bank?

This is worth asking given how HDFC Bank’s gross non-performing assets shot up in Q2FY24. From ₹18,301 crore a year ago, the number zoomed by 73 per cent to ₹31,578 crore in Q2FY24. However, the ‘denominator effect’, thanks to ₹23.55 lakh crore of loans curbed a jump in the NPA ratio. Factoring HDFC Bank’s steady NPA run-rate, at least ₹8,000–10,000 crore seems be the merger effect.

In a call with analysts, the management pacified investors that there shouldn’t be more googlies from HDFC’s wholesale loans. But net provisions at just ₹2,804 crore, down 9 per cent y-o-y and provision coverage ratio at 74 per cent don’t give comfort. There are also doubts on whether HDFC’s lease rental discounting model is permitted as structure for banks. If not, would it impact the HDFC Bank’s loan book further?

Margin impact

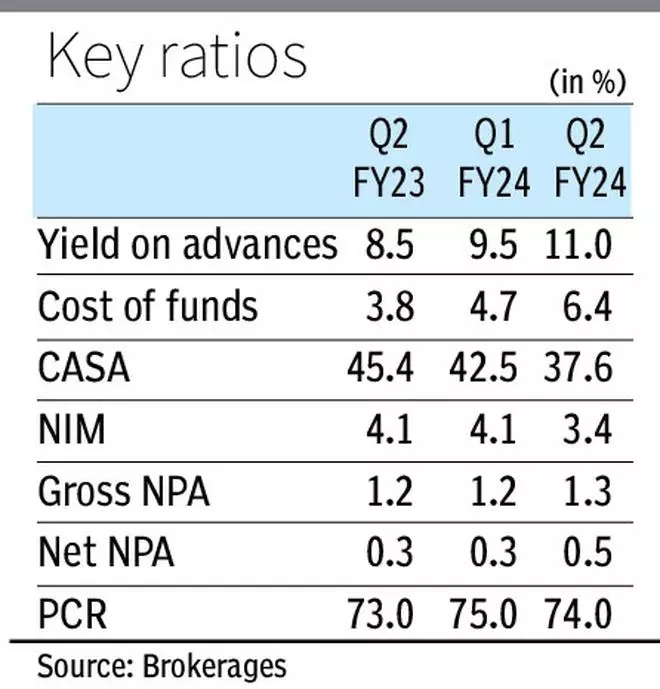

In April 2022, we indicated that the merger could be margin depletive by about 50–60 basis points. That’s playing out. In Q2, net interest margin dipped to 3.4 per cent from 4.1 per cent a year ago. But can HDFC Bank get back to the 4 per cent plus NIM zone once the merger pangs are behind it? Not easily.

NIM is a function of yield on assets and cost of funds. The latter rose from 3.8 per cent in Q2FY23 to 6.4 per cent in Q2FY24, while the share of CASA or current account–savings account deposits declined from 42.5 per cent in Q1 to 37.6 per cent in Q2. It is presumed that infra bonds of ₹ 1 trillion raised by HDFC can be carried forward by the bank, though the regulator hasn’t okayed it yet. If these bonds must be replaced by fresh liabilities, it could impact NIMs.

Yield on advances in Q2 stood at 11 per cent in Q2 as against 9.5 per cent in Q1 and 8.5 per cent in Q2FY23, suggesting that the retail loans of HDFC may not have been repriced completely yet. As that process gains momentum, it could again impact NIMs because home loans rates of banks are cheaper than NBFCs. The low-hanging option left to improve NIMs would be to increase the share of unsecured loans (credit cards and personal loans). Aided by the merger, share of these loans were at 11 per cent in Q2 as against the pre-merger level of over 15 per cent, leaving headway for the bank to push unsecured loans.

Valuations

Considering the two major headwinds, trading at around 2.6x FY24 one-year forward price to book, at a marginal discount to ICICI Bank, valuations have certainly come off for India’s once most expensive bank stock. While it may remain a 2 per cent return on assets and 20 per cent return on equity generating bank, it won’t be enough to propel the premium.

However, given the advantage of its size and its leadership position among private banks, difficult to contest in the medium-term, HDFC Bank stock is value buy for investors.